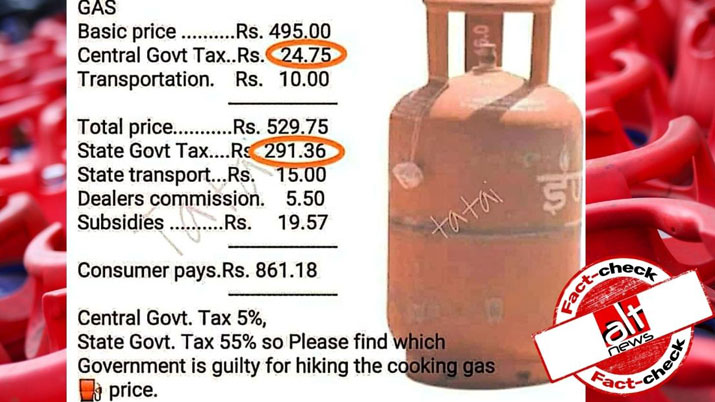

Amid the increasing cost of the domestic cooking gas, Liquified Petroleum Gas (LPG), a post took the internet by storm, according to which, the state governments charge nearly 55 percent tax on domestic LPG cylinders. The message claims to show that since states have a larger share of the taxation in the pricing of LPG, they are more to blame for the rising retail prices.

The text post lists the basic price of gas and adds state and central taxes, overheads and other costs. It then asks readers to find which government is ‘guilty’ for the high prices of cooking gas. Unlike petrol and diesel, where the central government and the respective state governments set their own indirect taxation, domestic LPG falls under the Goods and Services Tax, and is thus taxed uniformly at 5%.

The viral posts constitute a price break-up of an LPG cylinder. An LPG cylinder price includes basic price, transportation charges, dealer’s commission, subsidies, and the taxes levied by state and central government. The chart thus breaks down the cost and is followed by a statement at the end. The statement reads, “Central Govt. Tax 5%, State Govt. Tax 55% so please find which Government is guilty of hiking the cooking gas price”.

Assuming this viral claim to be true, several social media users are posting the same text post and are raising their voices against the issue. But, according to the Central Board of Indirect Taxes and Customs (CBIC) website, domestic LPG cylinders fall under the 5% GST slab. It is shared equally between the centre and state governments (CGST – 2.5% + SGST – 2.5%). The GST slab can be accessed on the CBIC website.

The Petroleum Planning and Analysis Cell (PPAC), a body under the Ministry of Petroleum and Natural Gas, monitors data and policy analysis of India’s hydrocarbons sector. The PPAC published a consolidated report of data and developments from different divisions and companies, called a ‘Ready Reckoner’.

In its November 2020 ready reckoner, PPAC data shows GST worth ₹28.30 was 4.8% of the retail selling price of LPG worth ₹594 as of November 1 at Delhi. In its June 2020 ready reckoner, PPAC data shows GST worth ₹28.25, again 4.8% of the retail selling price of LPG worth ₹593 as of June 1 at Delhi.

As per PPAC’s Ready Reckoner for May 2021, the dealers’ or distributors’ commission for domestic LPG is set at Rs 61.84.

On their website, under Petroleum prices, another document showed that the current commission rate for 14.2 kg domestic LPG cylinders has been in effect since October 2019. The rise in prices can be linked to the increase in international crude oil prices and the devaluation of the Rupee. The end consumer is further burdened as the government has eliminated subsidies on LPG

This price hike is applicable on all LPG consumers across the country. Currently there are 80 million Pradhan Mantri Ujjwala Yojana (PMUY) in India. There are around 207.2 million non-PMUY LPG consumers in the country.

Finance Minister Nirmala Sitharaman, in her February 2021 Budget speech, had announced a fresh target to add 10 million more PMUY recipients. This will take the total number of LPG consumers in the country close to 300 million by March 2022.

Thus, the aforementioned viral news is false as the claims made that the central government levies only 5% tax on LPG (Liquefied Petroleum Gas) cylinders, whereas the state governments charge a whopping 55% tax is false. It is shared equally between the centre and state governments.